Georgia Advance Care Planning Documents

In Georgia, there are four legal-binding documents available for Advance Care Planning:

Georgia Advance Directive for Health Care

Georgia Advance Directive for Health Care

O.C.G.A 31-32-1 et. seq. (2010).

Click here for a downloadable form with definitions and explanations.

The Georgia Advance Directive for Health Care (“Advance Directive”) combines the features of a living will and a healthcare power of attorney. A living will provides legal grounds to state your wishes for your medical care in case you cannot communicate for yourself. A healthcare power of attorney allows you to authorize someone, your healthcare agent, to act on your behalf in matters related to your healthcare when you cannot communicate for yourself.

The Advance Directive also allows you to state your treatment preferences in case of terminal illness or a state of unconsciousness. Specifically, it allows you to specify whether you want your life prolonged by artificial means. You may also nominate a guardian for yourself, and state your preferences regarding the disposition of your remains.

This document does not need to be notarized, but does require the signature of two witnesses who have witnessed you sign, and then signed themselves in your presence.

While there is some disagreement in other states as to whether an advance directive legally binding, be assured that in Georgia, it is. In 2016, The Supreme Court of Georgia found a physician liable for not following the instructions of a patient’s healthcare agent. Doctor’s Hospital of Augusta v. Alicea

Choosing an Agent

- We believe that each individual’s wishes for end of life should be respected.

- We strive for a peaceful death for every Georgian.

- Unlike other powers of attorney, the Advance Directive for Healthcare agency does not end at death. Your healthcare agent may be given authority to authorize an autopsy of your body, assent to organ donation or donation of your body to science, or to determine the details of the final disposition of your remains, such as burial or cremation.

- Your healthcare agent should be someone who you are comfortable having access to your healthcare information, who can be trusted not to abuse that authority, and someone who you trust to follow the directives you have outlined in your Advance Directive. In other words, you should choose a healthcare agent that you trust to make the decisions you would make for yourself, not the decisions the agent feels would be best for you. You cannot name someone as your healthcare agent who is directly involved in your healthcare, such as your doctor or caregiver.

- Your healthcare agent should be comfortable communicating your treatment preferences to your healthcare providers. For example, if you become terminally ill, you may choose the option to allow your natural death and ask that all treatments and medications be withheld. If you choose someone who believes you should “fight to the end” and would follow their own belief rather than your express directives, then that person is not a good choice for this position.

Georgia Statutory Financial Power of Attorney Form

Georgia Statutory Financial Power of Attorney Form

O.C.G.A 10-6B-1 et. seq (2017).

Click here for a downloadable form with definitions and explanations

In 2017 the Georgia General Assembly passed the Georgia Power of Attorney Act (“Act”), enacting the Uniform Power of Attorney Act, and adding a new chapter to the Official Code of Georgia’s Title 10. The Act also created the Georgia Statutory Financial Power of Attorney Form, which when completed and properly executed, is legally binding on 3rd parties.

Completing a financial power of attorney is a key part of Advance Care Planning. Planning for incapacity is part of Advance Care Planning, and in many cases, it will become part of end of life planning as well. Making sure that you’ve named someone to manage your finances at the end of your life should you become unable to do so for yourself is a crucial component that should be included in the Advance Care Planning process.

The financial power of attorney (also known as a general durable power of attorney) is immensely powerful and its power is often abused. The Act is designed to strike a balance between the principal’s need for flexibility in advance care planning, and the need for acceptance by 3rd parties of the agent’s authority. The Act provides protection for the principal if their agent misuses or abuses their power, or attempts to take advantage of a principal with diminished capacity.

The Georgia financial power of attorney form allows an individual to name an agent to manage their financial affairs when they are unable to do so for themself. The agent may be given complete or limited powers, and their authority may be immediate or springing, meaning only effective under specific circumstances described in the special instructions section of the document. It does not give your agent powers over your healthcare decisions, only your financial matters. It authorizes the principal’s agent to transact business on behalf of the principal, such as paying bills, and engaging in banking and real estate transactions.

Choosing an Agent

- Your financial power of attorney agent will be authorized to make decisions and enter into transactions concerning your property and financial affairs during your lifetime when you are unable to do so yourself. Because this the financial power of attorney is so powerful and is often abused, the person you name as your agent should be someone you trust completely; someone to whom you are willing to hand over your wallet and give all of your account numbers, passwords and PIN’s. Your agent’s authority will continue until you die, revoke the power of attorney, or the agent resigns. This document is called a durable power of attorney because your Agent’s authority is in effect even if you should become incapacitated during your lifetime.

- Your agent may be the same person you have named as your healthcare agent, or it may be someone different. If there is no one that you trust to manage your affairs, you may choose not to execute a financial power of attorney. If you have not executed one and you become incapacitated, the Probate Court may order a Conservator to manage your financial affairs under close court supervision. The conservatorship process can be time consuming, expensive, and potentially embarrassing so should only be relied upon as a last resort. Still, it is a better option than naming someone as your financial agent in whom you cannot place your trust, and who might abuse the power of the agency.

- When choosing a financial agent, it is best to choose someone who is local as many institutions will require your Agent to be at the institution in person to conduct your business. Also, if you are in an accident and rendered unconscious, your agent will need to act quickly to be able to assume the authority to act on your behalf and travel may be an obstacle. However, if there is no one that you completely trust who is local, nominate the person you trust the most and who would be willing to travel to your area if necessary.

- Before naming your financial agent, have a conversation with that person to be sure that they understand your financial condition, plans and goals. If you have an investment portfolio, real-estate investments, or other complex financial instruments, it is best to choose someone who has the knowledge and skills to manage those complex instruments.

- The powers vested in your Agent may be broad or limited, or you may designate special powers to be given to your Agent. The effectiveness of the Agent’s authority may be immediate or springing. If you are confident that your Agent will always act in your best interest and not try to use the power of attorney unless and until you are incapacitated, and you do not want your Agent to have to prove their authority or your incapacitation to every person with whom he or she deals on your behalf, designate your Agent’s powers as broad and immediate. If you are not comfortable with anyone having your power of attorney unless your incapacity has been established, designate your Agent’s power as limited and springing.

- If you choose not to make your financial agent’s authority immediate, you may choose the standard by which your incapacity may be established: (1) two physician’s statements of your incapacity by affidavit; (2) a statement by affidavit of some individually that you lack capacity; or (3) as determined by a committee who must agree by majority vote that you lack capacity to manage your financial affairs. The committee vote must be accompanied by sworn affidavits from each member. You may choose the people who will be on this committee.

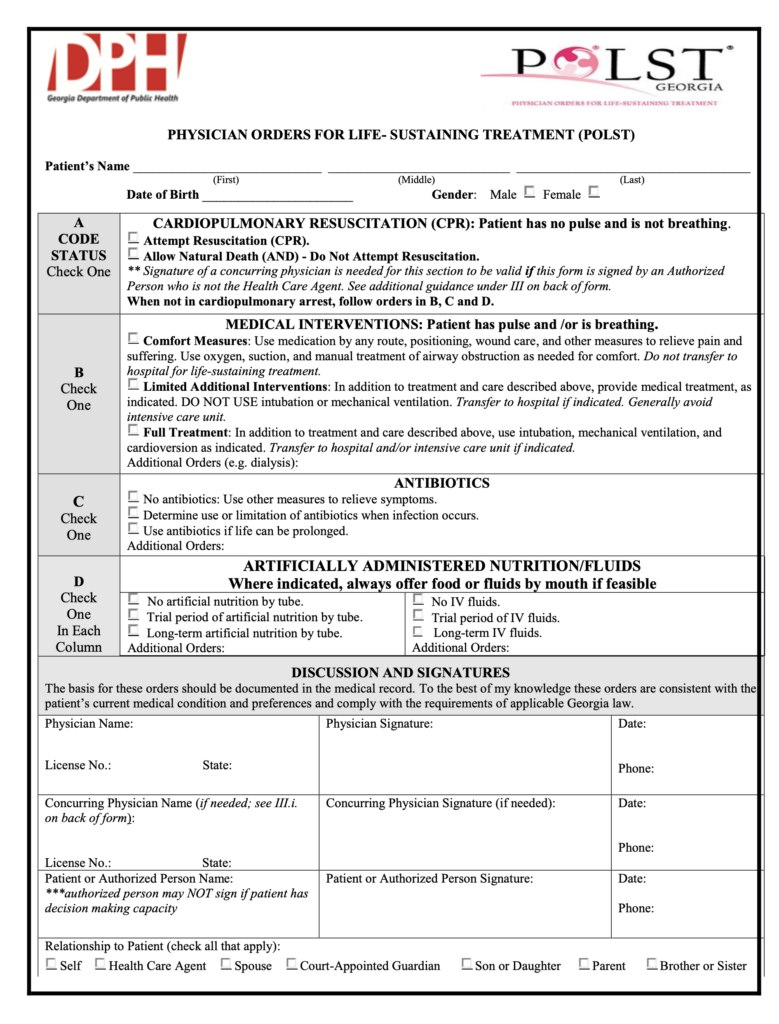

Georgia Physician’s Orders for Life Sustaining Treatment (POLST) Form

Georgia Physician’s Orders for Life Sustaining Treatment (POLST) Form

O.C.G.A 31-1-14 (2015)

Click here for a downloadable form

The POLST form is medical order form approved by ethe Georgia Department of Public Health. It is meant for use by those who have a serious health condition or are nearing the end of their lives. It is completed by a person with decision-making capacity and their attending physician. If the person does not have decision-making capacity and has designated a healthcare agent, the agent may complete the form on the person’s behalf.

The POLST tells others your wishes for life-sustaining treatment at the end of your life. The form is on generally bright pink paper so it can be easily identified in case of emergency. It is designed to assist those in the last phase of their life to have their medical orders travel with them during transfers to and from various healthcare facilities. The POLST form goes with you as you move from hospital to a rehabilitation facility, or to skilled nursing, care, or back to your home and community. No matter where you are living it is advised to keep the POLST form prominently displayed either on the refrigerator door, or by the phone, or by your bedside.

You should ask your doctor if the POLST form is right for you, and consider completing one if you reside in a long-term care facility or need long-term care services, if you might die within the next year, or if you want to avoid or receive some or all life-sustaining treatments. Some examples of life-sustaining treatments are cardiopulmonary resuscitation (CPR), intubation and mechanical ventilation, artificial hydration and nutrition, future hospitalization, feeding tubes, antibiotics, and pain and comfort care.

The Georgia Do Not Resuscitate (DNR) Form

The Georgia Do Not Resuscitate (DNR) Form

O.C.G.A 31-39-1 et. seq. (2011)

Download this pdf from the Georgia Department of Human Services for a template form, definitions, and explanations of Georgia’s DNR law.

The Georgia Law on Cardiopulmonary Resuscitation (CPR), provides a DNR form (also known as “No Code”) which allows a person to make a health care choice about one specific treatment – CPR. CPR is used when people stop breathing or their heart stops. The DNR tells the person’s healthcare team that the person does not want to be resuscitated.

Since a DNR is a physician’s order, the law provides that we request the form from our physicians, so each physician’s office or medical facility likely has their own form. And while anyone can draft the form according to the law, it must be signed by a physician to be effective. In our work at GAELO, we want people to consider having this form as part of their advance care planning package. If their physician is not offering it, we want them to be able to create one on their own and get their physician’s signature. That’s why we want to at least provide the statutory “form” as a template if someone needs to draft it themselves.

The DNR order is a medical order. It only refers to CPR and does not interfere or change any other treatments you may be receiving, either curative or palliative. Talk to your doctor about whether a DNR order is right for you.

The order may be requested by you, and the form may be completed by you or your doctor, but it must be signed by two physicians in order to be effective. Also, due to the specifics in the law, there may be circumstances when the order may not be carried out regardless of the person’s wishes due to the physical location of the person at the time of the emergency. A DNR may be revoked and should be reviewed with your doctor periodically.

The law also provides for a bracelet or necklace option in addition to the signed form. You may wear it on your wrist or ankle, or around you neck, and you must post a notice in your home in a prominent place to provide notice of the DNR order to emergency technicians. The bracelet or necklace must be substantially similar to ID bracelets worn in hospitals and must provide the following information: your name, your healthcare agent’s name and phone number (or next of kin, if no agent), the signing physician’s name and phone number, and the date of the order.